The Evolving Role of the Managerial Accountant

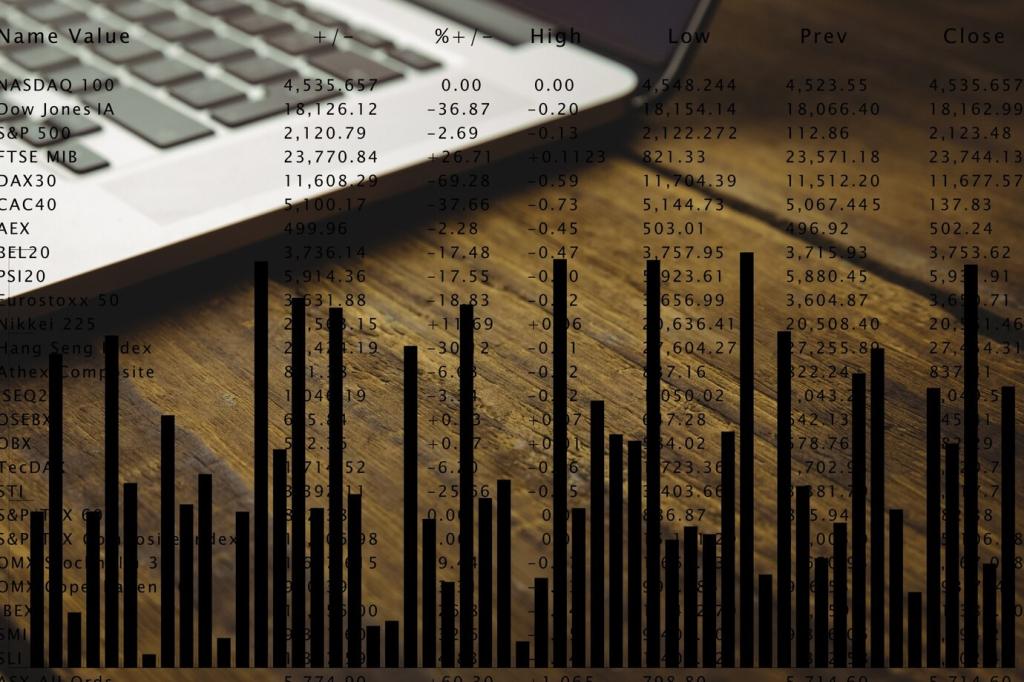

Accountants curate metrics, manage data products, and steward decision workflows. They orchestrate cross-functional alignment, ensuring every dashboard and forecast drives action. The job becomes storytelling with numbers, where clarity and timing matter as much as accuracy.

The Evolving Role of the Managerial Accountant

Data literacy, cloud economics, and experiment design rise alongside traditional costing. Practitioners learn to question models, interpret uncertainty, and influence choices. Mentoring, community forums, and hands-on labs accelerate growth across teams and career stages.